Paramount Skydance’s tender offer for Warner Bros. Discovery emerged from months of fitful courtship, a shifting media landscape, and a high‑stakes bidding war that ultimately pitted the studio behind “Top Gun: Maverick” against streaming giant Netflix for control of one of Hollywood’s crown jewels. The company’s tender offer regulatory filing with the Securities and Exchange Commission, filed hours after Paramount launched a hostile bid worth $108 billion (or $77.9 billion in equity), laid out a detailed chronology in which Paramount repeatedly tried to lure Warner Bros., to no avail. Netflix and Warner Bros. agreed a deal worth nearly $83 billion ($72 billion in equity) on Friday.

The filing revealed Paramount CEO’s last-ditch text message to WBD counterpart David Zaslav at roughly 4pm ET on December 4, the day before Netflix ultimately announced its deal, as previously reported by the Financial Times. “Daivd [sic], I appreciate you’re underwater today so I wanted to send you a quick text. Please note when you next meet as a board we wanted to offer you a package that addressed all of the issues you discussed we [sic] me,” David Ellison wrote as he apparently felt his target slipping away.

“Also please know despite the noise of the last 24 hours I have nothing but respect and admiration for you and the company,” Ellison added. “It would be the honor of a lifetime to be your partner and to be the owner of these iconic assets. If we have the privilege to work together you will see that my father and I are the people you had dinner with. We are always loyal and honorable to our partners and hope we have the opportunity to prove that to you. Best, David.” Later that day, Paramount sent Zaslav a letter criticizing a “tainted” sale process.

Paramount told investors today that it continued to believe it was never taken seriously. “During the entirety of the sale ‘process’ undertaken by the Warner Bros. Board, representatives of Warner Bros. did not provide a single markup of a single transaction document, have a single meeting to go page-by-page through the documents, or engage in a ‘real time’ back-and-forth negotiation with Paramount or its advisors.”

Early outreach in 2023

In 2023 and 2024, Paramount’s predecessor, Paramount Global, and Warner Bros. held intermittent talks about a possible merger, but those conversations ended without a deal as Paramount Global moved instead to merge with Skydance, under the control of current CEO Ellison. After that transaction closed in August 2025, Paramount’s new leadership revisited the idea of combining with Warner Bros., concluding that a tie‑up could create a stronger, scaled competitor to streaming platforms and big technology companies, according to the SEC filing.

The urgency increased in June 2025 when Warner Bros. publicly unveiled plans to split itself in two, targeting completion by mid‑2026, a strategy it continued to defend through early autumn. Paramount believed this breakup would destroy value and make any future full-company acquisition far harder, so it decided to move quickly, seeing a narrow window to buy all of Warner Bros. before the separation took effect.

Paramount’s escalating proposals

By early September 2025, the filing noted, media reports surfaced that Paramount was preparing an offer, helping push Warner Bros.’ share price sharply higher from a pre‑rumor closing price of $12.54—it was trading at $19.46 by September 15, the day after Paramount offered $19 per share in cash and stock. (The New York Times reported on the secret bids from Paramount in October.)

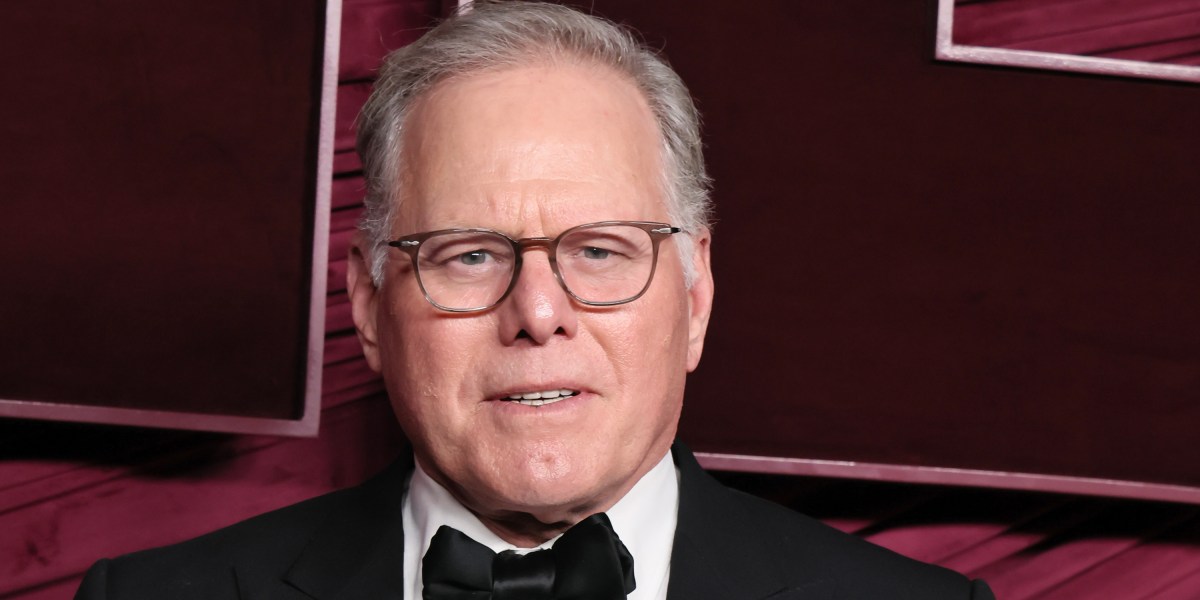

Warner Bros. rejected that approach within days, saying the bid undervalued the company and that its own breakup plan promised better long‑term value. Paramount responded on September 30 with an improved offer worth $22 a share, primarily in cash, and went further on deal protections, including a $2 billion termination fee and a commitment to litigate to secure antitrust clearance, while also dangling roles for Zaslav as co-CEO and co-Chairman of the board of the combined company.

Warner Bros. rebuffed this proposal as well, again calling it inadequate and insisting its planned separation remained superior, a stance that only hardened Paramount’s view that the board was underestimating the industrial logic of a combination. In October, Warner Bros. publicly announced a wider review of “strategic alternatives,” signaling that it would run a formal sale process and had received interest from multiple parties in both the whole company and specific assets such as its streaming arm.

Paramount attempted to enter that process on more favorable terms, pushing back on an initial Warner Bros. confidentiality agreement that included a lengthy standstill, tight controls on financing contacts and waivers of potential legal claims about the sale. Its advisers negotiated for a shorter standstill, “most‑favored‑nation” treatment versus other bidders, and freedom to challenge the process if Warner Bros. ultimately retreated to its separation plan, underscoring deep mistrust over how the auction might be run.

Due diligence and financing ramp-up

As the process unfolded, Paramount was granted limited access to a virtual data room, which it viewed as “sparsely populated” given the size and complexity of a potential deal. In mid‑November, Warner Bros. hosted an in‑person management presentation in California, while antitrust lawyers for both sides met to assess regulatory risks and lay out arguments that a Paramount–Warner Bros. merger would be pro‑competitive in a market dominated by tech‑backed streaming giants.

Parallel to those talks, Paramount’s board set up a special committee of independent directors to vet a large equity infusion from the Ellison family and private‑equity firm RedBird. Paramount also locked in a $54 billion senior secured bridge facility led by Wall Street banks.

A bidding war with Netflix

On November 20, Paramount submitted another improved proposal, lifting its implied offer to $25.50 a share, heavily weighted to cash and backed by signed debt commitments and promised equity. That bid included a $5 billion regulatory reverse breakup fee and more aggressive litigation undertakings, signaling Paramount’s willingness to fight regulators if required to close the transaction. (Netflix committed to a $5.8 billion breakup fee in its winning bid, which Bloomberg reported is among the highest of all time.)

Even as Paramount sweetened its terms, public commentary suggested some influential Warner Bros. figures saw Netflix as a more attractive partner, particularly for its pure‑play streaming focus and global reach. During a particular November 13 interview on CNBC, WBD chairman emeritus John Malone questioned Paramount’s intervention and discussed the merits of a Netflix deal, adding to market speculation that Warner Bros. leadership might prefer a streaming‑first tie‑up over a legacy‑studio merger.

Netflix deal and Paramount’s pivot to a tender

The process culminated on December 4, 2025, when Warner Bros. signed a merger agreement with Netflix that would see Netflix acquire Warner Bros.’ streaming businesses after a complicated internal reorganization and spin‑off of other assets. That deal offered cash and Netflix stock with headline value of about $27.75 per share but included adjustments tied to spin‑off net debt and a 21‑month outer closing date.

Paramount responded the same day with what it calls its “Prior Proposal,” a merger agreement valuing Warner Bros. at $30 a share in straight cash, with what it argues are stronger regulatory commitments, a shorter outside date and no price haircut tied to balance‑sheet mechanics. When Warner Bros. nevertheless chose the Netflix deal, Paramount concluded that the board had opted for an “obviously financially inferior transaction with extraordinary regulatory risk and a longer timeline to a possible closing,” and decided its only route was to go directly to shareholders.

Calls to Paramount, WBD, and Netflix to comment on the events as laid out in the filing were not immediately returned. We will update this post with any response.

Editor’s note: the author worked for Netflix from June 2024 through July 2025.

For this story, Fortune journalists used generative AI as a research tool. An editor verified the accuracy of the information before publishing.